Mapping the Future of AI in UK Manufacturing: Leaders, Opportunities, and What Comes Next

Artificial intelligence (AI) is no longer a futuristic concept in manufacturing, it is here, it is being deployed, and in some industries it is already changing the game.

From smarter production lines to predictive maintenance and AI-driven quality control, the technology is delivering measurable gains in efficiency, output, and competitiveness.

But not every sector is moving at the same speed. Some are accelerating toward smart factory maturity, while others are in the earlier stages, testing pilots and building the foundations needed for scaled adoption.

This IDS-INDATA benchmarking study focuses on mid-to-large UK manufacturers, which gives a clearer view of sector leadership and where the biggest growth potential lies.

Key Findings at a Glance

- Leaders: Automotive (60% adoption, 5/5 maturity) and Electronics & High-Tech (55%, 5/5) are furthest ahead, with AI embedded in core production and quality control.

- Strong Performers: Aerospace & Defense (50%, 4/5) and Pharma & Biotech (40%, 4/5) show high sophistication but uneven adoption across facilities.

- Mid-Tier: Chemicals & Materials (30%, 3/5) and Industrial Machinery & Metals (30%, 3/5) are moving from pilots to broader rollouts.

- Growth Opportunities: Food & Beverage (20%, 2/5) is in the early stages of AI adoption but showing rapid progress.

- Gap Drivers: Clean data, capital investment, and a culture of experimentation separate the leaders from the rest.

Why Focus on Mid-to-Large Firms?

SMEs matter, but they can mask the picture when we assess large-scale AI deployment.

Larger manufacturers usually have the capital, infrastructure, and workforce to implement AI at speed, so this analysis excludes SME data entirely to present an accurate view of enterprise adoption.

The Leaders, Mid-Tier, and Growth Opportunities at a Glance

The table below compares seven core manufacturing sectors on AI adoption, maturity, and investment level.

Table: AI adoption, maturity, and investment by sector (mid-to-large UK manufacturers)

| Sector | AI Adoption (%) | Maturity Score (1-5) | Investment Level |

| Automotive | 60 | 5 | High |

| Electronics & High-Tech | 55 | 5 | High |

| Aerospace & Defense | 50 | 4 | High |

| Pharma & Biotech | 40 | 4 | High |

| Chemicals & Materials | 30 | 3 | Medium–High |

| Industrial Machinery & Metals | 30 | 3 | Medium |

| Food & Beverage | 20 | 2 | Low–Medium |

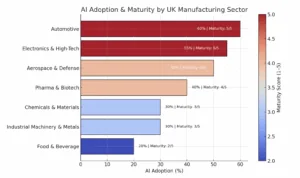

To make sector comparisons easier, we’ve combined adoption rates and maturity levels into a single visual.

Chart: AI Adoption and Maturity by Sector

Bar length = adoption rate; colour = maturity score.

This view makes it immediately clear that Automotive and Electronics & High-Tech dominate on both measures, Aerospace & Defense and Pharma & Biotech are strong but not universal in deployment, while Food & Beverage has the most potential for rapid gains.

Sector Insights

Automotive – The Clear AI Front-Runner

With around 60 percent of mid-to-large automotive firms using AI, this sector sets the pace for UK manufacturing. Companies use machine vision for quality control, predictive maintenance for robotics, and real-time supply chain optimisation. The result is a maturity level of 5/5 and faster, more reliable production.

Jaguar Land Rover, for example, uses AI-powered analytics across 128 sites to spot production anomalies in real time, cutting defects and reducing costs.

Electronics & High-Tech – Precision at Scale

This sector is close behind automotive.Manufacturers deploy AI for yield optimisation, smart sensors, and defect detection at microscopic levels, and many sites use digital twins to drive continuous improvement.

Siemens’ Congleton plant has predicted machine tool wear up to 36 hours in advance, preventing costly downtime and massively increasing production output.

Aerospace & Defense – High Sophistication, Targeted Use

Adoption is concentrated among the largest primes. Use cases include AI-powered design optimisation and non-destructive testing, with predictive maintenance reducing downtime on complex equipment.

Rolls-Royce has used AI-based digital twins to cut turbine blade defects by 15%, while BAE employs AI to coordinate advanced machining and assembly.

Pharma & Biotech – The Intelligent Pharma Shift

Pharma manufacturers are extending AI from R&D into production. AI supports quality assurance, accelerates batch release, and helps automate documentation in regulated environments.

GSK has implemented AI-driven real-time release testing, enabling products to hit the market faster without compromising compliance.

Chemicals & Materials – Cautious but Growing

Adoption is rising from a lower base. Early pilots in process control optimisation and energy efficiency are demonstrating value, which is driving broader investment.

INEOS’ AI-enabled furnace optimisation has cut energy use by up to 10%, showing strong ROI potential.

Industrial Machinery & Metals – Gradual Progress

This diverse sector is constrained by legacy infrastructure.AI is improving welding quality, scheduling preventative maintenance, and integrating robotics into assembly lines.

Tata Steel’s AI-driven emission control system is a good example of analytics improving both efficiency and sustainability.

Food & Beverage – A Sector with High Growth Potential

Adoption has risen quickly. Firms are using AI for energy management, demand forecasting, and vision-based quality control, which reduces waste and boosts output.

Arla Foods UK uses AI to predict milk yields and optimise dairy processing schedules, cutting waste and reducing energy use per unit.

With targeted investment and scaling, this sector could leap forward in the AI maturity rankings.

What’s Driving the Gap Between Leaders and Emerging Adopters?

Three main factors explain why some sectors are racing ahead while others are still in early trials:

- Data Readiness – Leaders already have clean, connected data systems to feed AI models.

- Capital Investment – AI requires upfront spending in infrastructure, talent, and integration.

- Cultural Openness – Willingness to experiment and integrate new technologies quickly.

Why This Matters

The difference between a leader and an emerging adopter in AI adoption is not just technological, it is competitive.

Firms that integrate AI across operations will pull ahead on efficiency, product quality, and responsiveness. Those that delay risk losing relevance.

For IDS-INDATA, this benchmarking offers more than insight – it provides a targeted engagement roadmap, showing exactly where our solutions can have the greatest impact.

We Can Help

If your sector is in the mid-tier or high-growth potential category, now is the time to act.

Contact IDS-INDATA to explore how we can help you move from AI ambition to full-scale deployment – and join the leaders shaping the future of UK manufacturing.